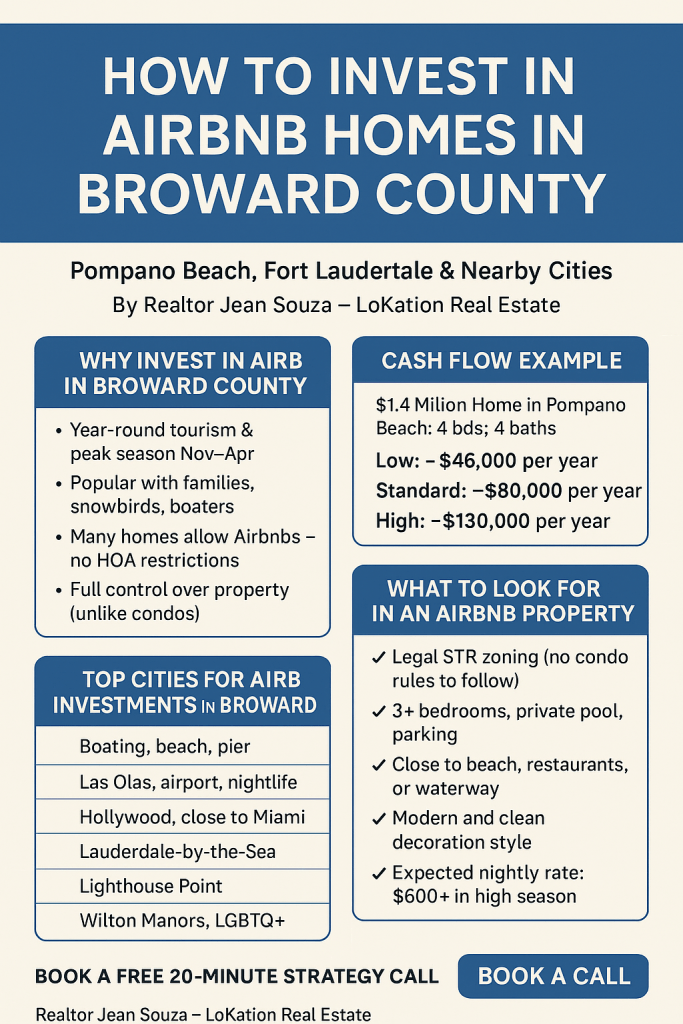

Pompano Beach, Fort Lauderdale & Nearby Cities

Why This Guide?

If you’re curious about making money with Airbnb real estate—but don’t know where to start—this guide is for you.

I’ll walk you through how to find and invest in the best properties in Broward County that are already legal for short-term rentals (STRs), and I’ll show you what kind of profit you can expect.

🌟 Quick Summary (TL;DR)

- Best deals: Single-family homes or duplexes that don’t have an HOA and are close to the beach, waterfront, or nightlife.

- Ideal price range: $1M–$1.7M (cash buyers welcome).

- Potential earnings: $150K–$200K+ per year.

- What you’ll get with me: A free “Luxury STR Deal Kit” + weekly off-market listings and expert guidance.

📍 Why Invest in Airbnb in Broward County?

Broward County is a hot vacation spot all year long. Here’s why investors love it:

- It attracts families, snowbirds, boaters, and luxury travelers.

- Peak rental season runs November–April (snowbird season).

- Certain areas let you legally run an Airbnb without HOA restrictions.

- These homes offer control—unlike condos—with features like pools, parking, smart locks, and increased rental rates thanks to flexibility.

🗺️ Top Cities for Airbnb Investments in Broward

| City | Why It’s Great | Airbnb Legal? |

|---|---|---|

| Pompano Beach | Boating, beach, pier | Many Airbnb-friendly areas |

| Fort Lauderdale | Las Olas, airport, nightlife | Strong rental framework |

| Hollywood Beach | Boardwalk, close to Miami | STR-friendly zones |

| Lauderdale-by-the-Sea | Walkable + charming | Vacation rental hotspot |

| Lighthouse Point | Quiet luxury & docks | High-end guest appeal |

| Wilton Manors | LGBTQ+ friendly, nightlife | Strong nightly demand |

💰 Example: $1.4M Airbnb Home in Pompano Beach

Property: 4 bedrooms, 4 bathrooms, pool, near waterfront

Estimated Income (After Expenses)

- Low estimate: ~$46,000 per year

- Standard estimate: ~$80,000 per year

- High estimate: ~$130,000 per year

💡 These numbers include cleaning, utilities, taxes, and optional 20% property management.

📈 Self-managing could increase your return to 10% or better!

✅ What to Look For in an Airbnb Property

- ✔️ Legal STR zoning (no condo rules to follow)

- ✔️ 3+ bedrooms, private pool, parking

- ✔️ Close to beach, restaurants, or waterway

- ✔️ Modern and clean decoration style

- ✔️ Expected nightly rate: $600+ in high season

🛑 Avoid properties that:

- Have strict HOA rules

- Are in areas where Airbnb isn’t allowed

- Are hard to insure (high flood risk or outdated systems)

🔍 Frequently Asked Questions

Is Airbnb legal here?

Yes—but it depends on the city. I help by checking zoning and rules for each property.

Why focus on single homes, not condos?

Most condos don’t allow short stays (under 30–90 days). With houses, you have full control.

Do I need to buy in cash?

Cash makes offers stronger in this market, especially for $1M+ properties. But financing is possible.

What about property management?

You can handle it yourself or use full-service management (15–25% of revenue). I can refer trusted partners.

Can I use 1031 exchange funds?

Yes, vacation rentals can qualify as long-term investments under IRS rules.

🔗 Related Posts

- [Florida 1031 Exchange Guide]

- [Pompano Beach vs Fort Lauderdale: Which Airbnb Market Wins?]

- [How to Underwrite a Luxury Airbnb in Florida]

- [Work with STR Buyer Specialist – Jean Souza]